Roth IRA vs. Traditional IRA. Which Individual Retirement Plan is Better For You?

One day you will have to retire and to prepare for that day, you will have to make some decisions. Namely, should you use Roth IRA or a traditional one?

To put it bluntly, if you expect your tax rates will increase, go with Roth IRA. On the flip side, you might expect a lower tax bracket for your retirement. If that is the case, a traditional IRA is the way to go.

And lastly, if you really cannot make a good assumption, try splitting it. You can decide to contribute to both Roth IRA and a traditional IRA every year. As long as you stay within the limits, the IRS will allow you to do so.

Can the answer really be that simple?

Of course not. It is definitely a simplification of the answer. However, it is a helpful rule of thumb. If you want to have more information to make a decision you should consider differences and difficulties for both. So, let’s cover them.

The Obstacles

There is a reason many stay aside instead of jumping on board and benefiting from an IRA. Mainly, the amount eligibility issues and the overwhelming amount of choices. So, let’s help you with those:

- When it comes to Roth IRA, you are only allowed to save a certain amount (based on income parameters). And a regular one will only allow you to deduct a certain amount from taxes. So, to see how much you can save, make sure to do your research.

- If you are having difficulties making a decision let’s narrow it down. If you want to manage your IRA investments yourself, you can go with a brokerage firm that offers a discount. Willing to allow a service do it for you? Automation is always a good option. A robo-advisor can get it done for you.

The Differences

One thing these plans have in common is that you can save for your retirement with certain benefits regarding taxes. However, there are important differences to note.

1. Taxes

The main difference between these two versions of an IRA lies with the tax break. Both have advantages. With a traditional IRA, you can deduct your contribution from your taxes. However, with a Roth IRA, you will not have to pay taxes for withdrawals.

2. Limits

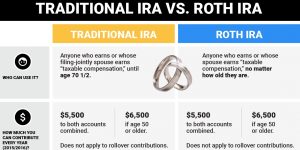

Another similarity worth noting is that both have rules and restrictions when it comes to contributions. In fact, you can contribute to both as long as you do not go over the maximum contribution. That would be $5,500 or, if you are over the age of 50, $6,500.

With a Roth IRA, household income determines the limits. So, sometimes, those with higher incomes might not be eligible to contribute in certain years.

On the other hand, the income doesn’t dictate how much you can contribute with regular IRA. It merely affects how much you can deduct from the taxes.

3. Early Withdrawals

With a traditional IRA, this is not something we would recommend. In fact, there are deterrents in place. If you are younger than 59.5 years and you will have to pay for them. Not only will you have to pay the income tax, but the IRS will take another 10% penalty. However, with Roth, you will be able to withdraw your funds early with no payments. As long as your first contribution was at least 5 years ago

4. Required Minimum Distributions

The main difference when it comes to RMDs is that, with a Roth IRA, there are no rules. If you want to keep amassing funds after you are 70, you can continue to do so. If you do not need the funds, but you want to leave a larger inheritance, Roth will let you do so.

The Verdict:

In essence, these are the high points of how these two work. The rest is up to you. Do your research, and make your choice accordingly.