Why Too Much Reading and Studying is a Waste of Time

Whenever a beginning investor would ask for tips on how to invest in the stock market, he/she would most probably get the response of, “Read and study. Invest on educating yourself first.” I couldn’t agree more. In fact, one of the biggest mistakes that beginners make is that they jump right into investing without building a strong foundation on financial literacy.

However, I would not advise for you to read too much.

What is THE goal?

Remember that financial literacy is the foundation, not the goal. The less time you spend on building up your foundation by reading, the earlier you could start reaching that goal. But take note that the lesser time spent reading DOES NOT always equate to a lesser quality of education, though that’s what happens most of the time.

Why waste of time?

How many finance books have you already read? I’d assume that you learned something from all of them. But were you able to apply them in real life?

Also, most materials of the same niche would probably have the same content, just written in a different manner by different authors. How many of those were just a “repeat” of the other?

Just like my post about how not to diversify your portfolio, you only need a few right decisions to be rich. It’s the same case in reading.

The three (3) books that I highly recommend.

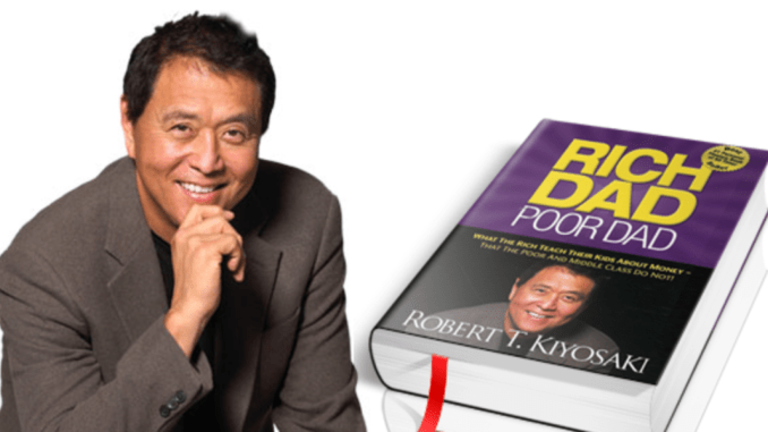

Rich Dad, Poor Dad by Robert Kiyosaki

If investing sounds Greek and a whole new planet for you, then this book is for you. And if you think that My Maids Invest In the Stock Market is an eye-opener, then try this.

In here, you’ll realize that whatever you learned in school does not and will not prepare you on the terror lies ahead in life. But it does prepare you on one thing – your future desk job.

Personally, I like how this book was written because of the choice of words. Here are some excerpts:

“If you want to learn to work for money, then stay in school. That is a great place to learn to do that.”

“Mike and I learned more sitting at his (referring to Mike’s dad) meetings than we did in all our years of school, college included. Mike’s dad was not school educated”

Take that!

To sum up the whole book, it basically tells you to build your asset column and stop spending on liabilities that you think are assets. If you’re investing in the stock market but did not understand what I meant, then I seriously advise you to read this.

8 Habits of the Happy Millionaire by Bo Sanchez

If Rich Dad, Poor Dad teaches you what you should do to get out of the rat race, this second book that I recommend will teach you HOW to do it.

Compared to western countries, Filipinos have a different way of spending money. For one, most of us still support our parents, and extended families for some. That’s why I recommended a book that’s written by a Filipino author.

The best chapter in this book for me is where Bo taught us how to divide our income into several parts (expenses, retirement, emergency, etc). If you’re too lazy to read the whole book, just read that chapter and you’re good to go.

For me, the two books that I mentioned above is already enough to build your foundation. Anything more than these is just extra. In my point of view, it will already be a waste of time.

For those venturing in the stock market, here’s my last recommendation:

The Tao of Warren Buffett by Marry Buffett and David Clark

For value investors, this is the best book that I can recommend. Most, if not all the stock principles that I apply came from here. This book is a summary of all the Warren’s investment strategies and beliefs.

I tried to love technical analysis but I’m always drawn to value investing because of this book. Needless to say, I cannot recommend a technical analysis material because it has never worked for me.

This book is has been the backbone of my top 5 stock picks, and is the reason why buy and hold (but not forever) is my most favorite strategy and why I don’t diversify.

You may buy a Kindle copy of these books at Amazon (roughly $11 for The Tao and $5 for Rich Dad). Note: I will earn a small commission if you buy using the link above, at no extra cost to you. Thank you very much!

Why do I recommend these three (3)?

These are examples of evergreen materials. The concepts and solutions that they offer are not bounded by time. They would remain true and applicable in many generations to come.

Are there other reading materials that you’d like to recommend?

Whatever I apply in my journey towards financial freedom was based from these three (3) books. From mindset down to application, they were all taken from these three. I’ve read a few best-sellers, but trust me, if I recommend them, I’d put them here.

I’m sure there will be questions why I don’t recommend some best-sellers and favorites, specially the ones written by Bo Sanchez. If you think there are reading materials that I should include here, please drop them in the comments and tell us why. Like what I’ve said, I’ve only read a few best sellers. I’m sure there are books that you’ve read but I haven’t. Please do share. Other readers might pick up a thing or two from it 🙂