How Many Stocks Should I Own?

What is the right number of stocks to own in order to be diversified? Is it 5, 10 or 50? There are many theories on this subject and each investor should take into consideration their individual situation. This article will explore some of the main points that one should consider when deciding how many stocks they should have in their portfolio. First, you need to decide what your goals are for investing. If you’re saving for retirement then having a diverse portfolio with more than 50 investments may not be necessary because you have decades before needing access to your money. On the other hand if you want shorter-term high returns then it would make sense to invest in fewer companies so that your profits can compound from dividends and share buybacks sooner rather

How many stocks should I own

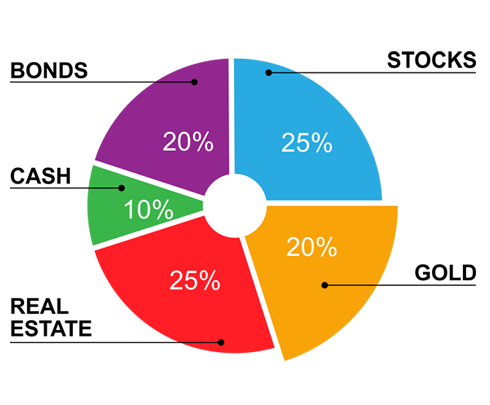

How many stocks you should own depends on how long you will be investing. Longer time horizons mean a larger holding of your portfolio in cash and bonds.

There is no perfect answer to the question of how many stocks you should own. The short answer is that you should invest in the companies you actually want to own. That said, you also need to diversify to keep your portfolio safe.

Why you need to diversify your portfolio

Diversification is important for investors. The aim of diversification is to reduce risk, either by spreading investments around in different sectors, or by buying a selection of individual stocks.

More than 60% of the time investors will earn higher returns by diversifying their portfolio. A good way to understand how this works is to think about how you are rewarded for taking on more risk with your investments.

How to Diversify your portfolio

There are two main ways that you can diversify – diversifying across industries and diversifying within industries. The first way, spreading investments around different sectors of the market is how most investors think about how they try to be comfortable with their investment choices. By investing in a good mix of industries, like value stocks and growth stocks, you may be better protected in down markets.

Diversify within industries

The other way to diversify your portfolio is by investing in a variety of different companies within each industry. You can gain protection from downturns without spreading your money around too much by focusing on how far the individual companies are from their competitors. If all the companies in a certain industry are trading at roughly similar valuations based on how well they compare to how other companies in the same industry, then you may be less exposed to downturns. On the other hand if your portfolio is spread across many different kinds of businesses, some of which are more cyclical than others, you may be more vulnerable to the kinds of downturns that affect some areas of the market more than others.

How many stocks should I own in each industry?

You need to decide how diversified your portfolio is going to be and how much money you have in order to make investment decisions on how many stocks you can hold in each industry. If you have a small amount of money and are trying to invest at high valuations, then it may be better to focus on how far the companies in a certain industry are from their competitors.

How many stocks should I own overall?

The last part of how to choose how many stocks you hold is how many you are going to hold overall. The right number of stocks to hold depends on how long you have been investing for, how much money you have, how much risk tolerance you can handle and how well-diversified your portfolio is going to be.

Final Thoughts

To sum up this how many stocks should I own post, how many stocks you should hold is a answer to how diversified your portfolio is going to be and how much money you have in order to make investment decisions on how many stocks you can hold. If you are just starting out with investing and don’t have that much capital then it would probably be better for you to focus on how far the companies in an industry are from their competitors. On the other hand, those who have been investing for a while and have invested at high valuations may be better off with how well-diversified their portfolio is going to be.