Tips to Make Budgeting Work

The goal of budgeting should be to help you achieve your financial goals. A budget is nothing more than a plan for how you will manage your income and expenses. While the thought of budgeting sounds tedious to many people, budgeting doesn’t necessarily have to be complex or time-consuming. Choose a budgeting method that you can stick to; whether it be a formal budget where you have an extensive list of income/expense categories and you track your actual income/expenses as a comparison or you can make it as simple as setting aside a specified amount of cash that you can use each pay period for expenses like food and entertainment.

When we live without any type of plan for how we will spend our money, we often end up spending it all; leaving no money left over to put towards our financial goals. The important thing is to find a method of budgeting that works for you and helps you to achieve your financial goals.If you are not already budgeting, take some time out today to come up with a plan on how you can better manage your expenditures.

Here are some budgeting tips:

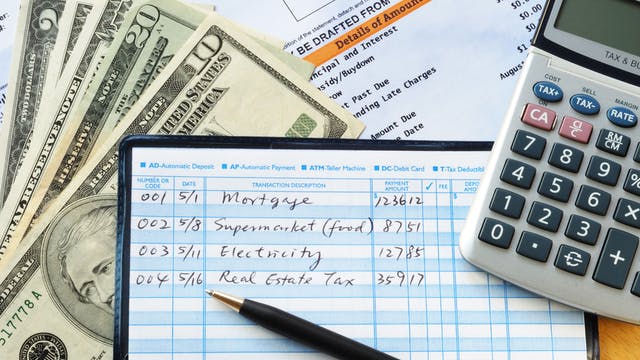

1. Keep it simple by reducing the number of categories you use in your budget. Many people start out by using very specific categories. Instead of using five different categories that deal with food (such as “eating out”, “fast-food”, “snacks”, “groceries”, etc) just have a “Food” category. The key is to simplify things. If you find that you are spending too much in any particular category, then you can break down that category to manage it on more of a micro level; otherwise, there’s no need to create more work for yourself.

2. Choose a budgeting medium that is easily accessible to you. For some people, using budgeting apps on their cell phone works great since they always have their cell phone on them; for other people, just using a dry erase board that is hanging in their kitchen is the most convenient. The trick is to take the “chore” out of budgeting. Make keeping up with budgeting convenient and accessible.

3. Start out with a more lenient budget. Just like jumping into a restrictive diet will often cause you to fail and quit, too strict of a budget may also cause you to quit. Start with a budget that is more manageable and then make adjustments to it as you gain momentum and see the positive results of sticking to a budget.

4. Keep your eye on the prize. The purpose of budgeting isn’t to turn you into a numbers nerd (like me), but it is to help you save money for the things that you value. Measure how much your budget is helping you to achieve your financial goals. Make some kind of chart or tally of your goal progress and hang it where you will see it on a regular basis. It can be as simple as drawing a thermometer on a piece of paper and coloring it in as you come closer to achieving your goal.

5. Sit down with your spouse and come up with a budget that you can both honestly work with. Unfortunately, we are not always on the same page with our spouse when it comes to spending. If your spouse isn’t quite on board yet, be willing to meet them at their level of commitment. Expecting them to give up their cherished daily latte may prove to be frustrating and unproductive.

As a side note, here’s a money quote that I recently came across that humorously addresses the buying habits of Americans:

“The only reason a great many American families don’t own an elephant is that they have never been offered an elephant for a dollar down and easy weekly payments.” –Mad Magazine