Value Investing: Factors to Consider

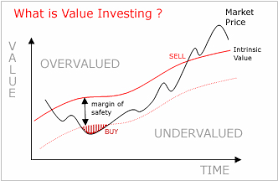

The main idea behind value investing is fairly straightforward. When the market lowers the stock price for one company, an investor would see this as an opportunity to make a profit. However, he only assumes that there will be a correction in the valuation soon.

Why are there contradictions?

Value investing has a contradictory trait when compared to EMH. The efficient market hypothesis states that all stocks trade at their fair value. In addition, if there are fluctuations in the price, the reason behind it is the overreaction of the market to relevant data. However, many argue that value investing is a fantastic way of stock-picking. People like Warren Buffett, and even Benjamin Graham, have proved everyone wrong by delving into this method.

Investors are not buying junk stocks

Even though value investing means that you are searching for a bargain, the stocks you get do not have to be bad. Whatsmore, it means that you are getting a deal for a stock that has strong fundamentals and fantastic historical performance.

For example: let’s say we have two companies that are trading their shares for $25. Suddenly, the prices drop, and you can get a share for $10. But, how do you choose? You have to research both companies and decide which one has better fundamentals. If company A has strong management and great performance, then it is a bargain, and you should buy the share. However, if it is plagued by poor performance and weak leaders, then it’s not a good choice.

The main idea behind it is the assumption that the drop in price is just temporary.

Owning the company

How the value investor views the company he’s buying stocks from is vital for this method. Unlike other investors, he doesn’t care about external factors like market volatility. Instead, he aims to invest in companies that are worth the trouble – those that have powerful fundamentals. Because of that, he doesn’t buy shares just to trade them – he is actually looking for ownership and profit.

Factors to consider

Value stocks are trading on NYSE, Nasdaq, and all other stock exchanges. Furthermore, you can find them in all sectors – utilities, energy, healthcare, etc. However, there are certain factors you should consider before deciding on a particular company:

- The share price should be about two-thirds of the intrinsic value. If the value is $30, then the price should be $20 or less.

- The stocks should have less than 40% P/E ratio. That ratio evaluates the current share prices in comparison to the per-share earnings.

- They should also have a low P/B ratio. This is a comparison of the stock market value to its book value. Usually, investors try to find those that have a below industry average ratio.

- Low price/earnings to growth. The PEG ratio determines the stock’s value while evaluating the earnings growth as well. Value investors typically search for stocks that have a below one PEG ratio.

- Low debt/equity ratio. This metric defines the company’s leverage. However, you should be careful when comparing companies that are in different industries. In some sectors, the D/E ratio is high, while in others, it is common to have a lower one.

- The dividend yield percentage. It should be a bit lower than the long-term AAA bond yield – at least two-thirds.

- The earnings growth. It should be at least 7% or higher. In addition to that, during the past ten years, the company should not have had more than two years of decline.

Stay on the safe side

It is difficult to determine the intrinsic value of a stock on your own. You can always use online resources as a guide or calculate the number yourself. However, when doing the analysis, always use a lower number. For example, if you think that a certain share is $25, then put $21 instead. That way, you will have a margin of safety which will help you avoid overpaying the stock.