How Your Investment Portfolio Should Look as Your Grow

If you want to have a worry-free retirement, you should start making bigger investments as soon as possible. When it comes to investing, the biggest advantage you can have your side is time. This means, the earlier you start investing, the more time your initial investment has to grow.

The question, of course, is how should you invest your money? This largely depends on where you are in your life. In fact, your portfolio will look considerably different at different points in your life. And now, let’s take a look how your portfolio is going to look during every decade of your investment career.

How Should Your Portfolio Look at 30?

When your investment career is just starting, you have almost three decades to profit from various investment markets before you retire. As they say, you have all the time in the world at this point.

Even if stock prices plummet at a certain point, this won’t hurt your portfolio too much, because you can easily recoup your losses. If you can deal with the volatility of the stock market, you should invest aggressively in your 30s. Here are some of the options you have:

- Investing in your 401K or 403K: During this period, you should try to contribute at least 10% of your income to your 401K or 403K fund. This will allow you to have a financially secure future.

- Investing in a Roth IRA: In case you don’t want to give extra cash to your retirement fund, you should take a look at Roth IRA. And if you can meet their income guidelines, you’ll be able to invest more than 5K in after-tax money.

- Investing in Stock Funds: Although bonds are clearly more stable, if you’re looking for a way to increase your money in the long run, you can’t really beat stocks. If you’re a risk-tolerant investor, you should invest around 70% in stock funds.

How Should Your Portfolio Look at 40?

Now, if you’re in your 40s and you still haven’t started investing, you might feel like you’re a little bit late to the party. However, you shouldn’t worry too much, because there are still some options for you.

For instance, even if you haven’t saved anything in your workplace retirement plan, you can still start. You just need to invest 18K every year. With a 6% annual returns, you’ll be able to reach a million by your 67th birthday. One more option is asset allocation.

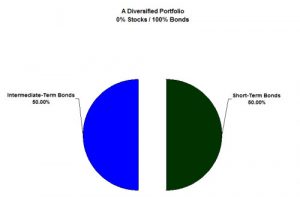

In your 40s, asset allocation should lean towards fixed investments and bonds. While the ratio of stock to bond investments differentiates depending on how much risk you’re willing to take. If you’re a conservative investor, you should be fine with 60-40 stock to bond allocation.

On the other hand, if you still want to make more aggressive investments, go with an 80% stock allocation. Keep in mind, the more holdings you possess, the more unstable your portfolio is.

How Should Your Portfolio Look at 50?

Once you reach the tail-end of your investment career, it’s the time to look at your goals and re-examine your future lifestyle. Take a good look at your current tax situation, current and projected income. By analyzing this, you’ll be able to guide your investments in your 50s.

Needless to say, if you’re on the right track, you should just keep doing what you did during the first two decades of your career. During this time, however, you are probably going to dial back your stock fund exposure and increase cash allocation.

The Bottom Line

At the end of the day, your investments will be dictated by your progress toward personal financial goals. As we said at the beginning of the article, start investing at an early age if you want to have financial security once you finally retire.