How to Properly Allocate Your Portfolio

When it comes to investing in a retirement plan or a brokerage account, you usually have three options: bonds, stocks and of course, cash. So the biggest question is, how much of your assets should be in stocks, bonds and how much in cash?

Unsurprisingly, there’s no universal solution in this case. The answer to this question largely depends on factors like your age, risk lenience, and how much time you have before your retirement. In this article, we’ll try to help you achieve best asset balance in your portfolio.

Bonds and Stocks

The first thing you should determine is how much assets you should own in bonds and stocks. Now, the biggest factor here is your age: young people should hold more of their assets in stocks, while older people should shift some of their assets into bonds.

If you want to find out your stock allocation, you should just take the number 110 and subtract your age. So for instance, if you’re 30-years old, roughly 80% of your assets should be in stocks. Obviously, this is just a rule of thumb, there are different formats, depending on how much you’re comfortable with risk.

Cash Assets

When talking about cash assets, things are a little simpler. In short, while you should have a nice amount of cash stashed away in easily accessible places, you shouldn’t keep too much money in cash accounts. Most financial experts recommend that you keep around six months’ worth of living expenses in cash.

You should always have an emergency fund on hand, however, we recommend that you keep somewhere between 90% and 100% of your investments in bonds and stocks. And just to point out, when we’re saying “cash” we refer to real cash investments.

Investing in Stocks

As you probably know, whether you want to buy mutual funds or select individual bonds, you have a ton of choices out there. If you’re not too familiar with different types of stocks, here’s a quick rundown that will help you figure out your allocation:

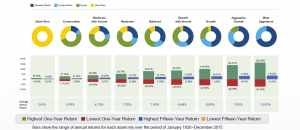

- Growth stocks: These are the companies that grow faster than others. This type of investing is riskier than ordinary value investing.

- Value stocks: The main objective here is to find companies with undervalued stocks and produce larger returns over time.

- Large-cap: Although definitions vary, in general, large-cap stocks are ones with a market capitalization of five billion dollars or even more.

- Mid-cap: Here we have stocks from companies that have a market capitalization anywhere between one and five billion dollars.

- Small-cap: Lastly, we have small-cap stocks – these are the companies that have a market capitalization less than one billion dollars.

Lifecycle Funds

Lifecycle funds, more commonly referred to as target-date retirement funds, are mutual funds that invest in a combination of bonds and stocks. These funds slowly shift their asset allocation from stocks to bonds as it’s moving to the target date.

Let’s explain this in more detail. For example, a fund intended for people retiring in 2050 will have around 80% of assets in stocks and around 20% in bonds. On the other hand, a fund for people who are retiring in 2025 will have a 50-50 balance of assets. This balance varies from company to company, but the idea is basically the same.

Final Thoughts

In order to determine the best asset allocation for you, you have to go back and reassess your particular, personal situation. This will help you get the right mix of growth and income and allow you to relax knowing that your future is being taken care of.